Energy sector out-performance lies ahead

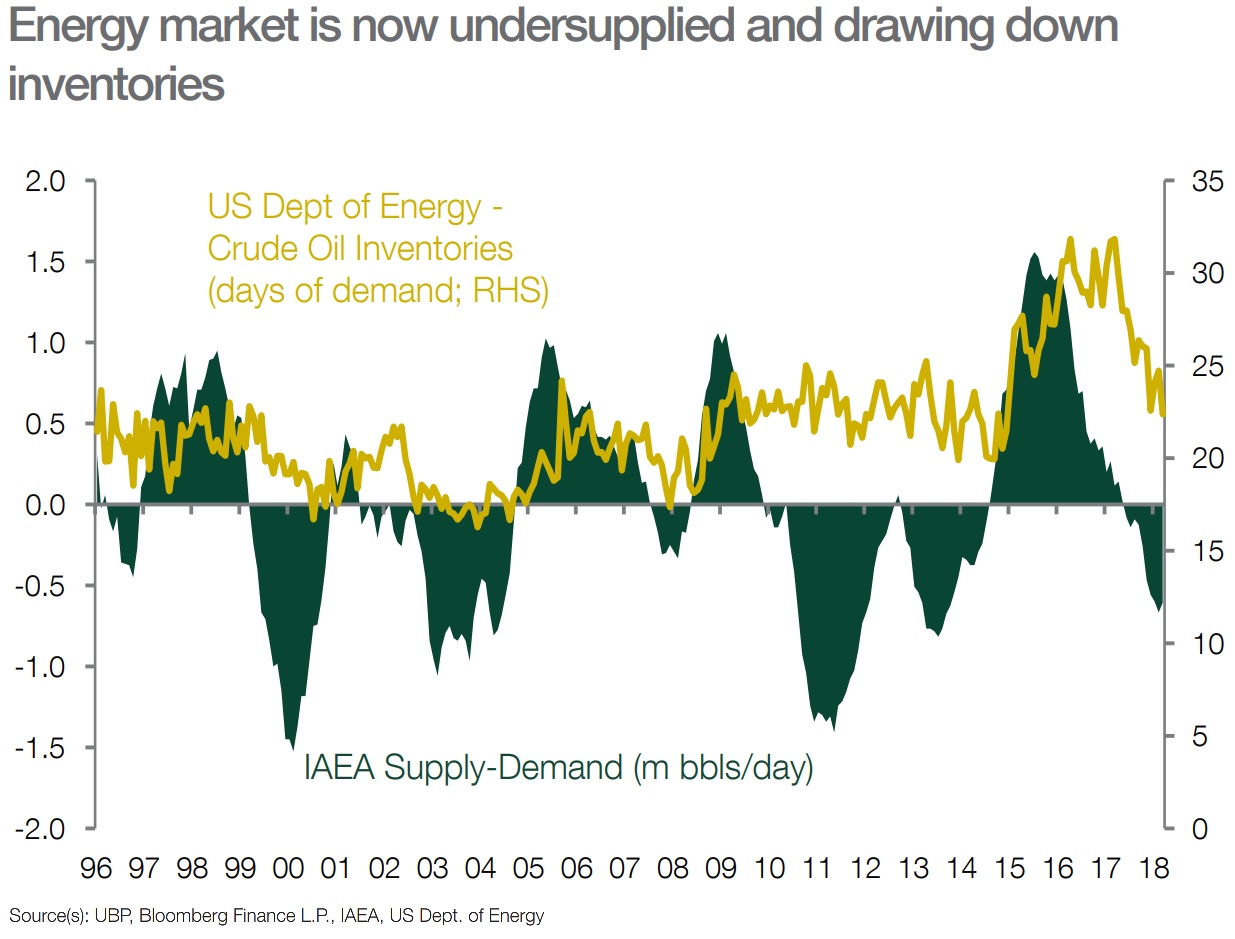

Having ended 2017 as one of the worst performing global sectors, sustained out-performance lies ahead for energy stocks in 2018. The underlying crude oil market is now under-supplied while inventory levels have fallen sharply. These supply-demand and inventory dynamics have historically translated into improving corporate profitability over the coming 12-24 months.

- The current supply-demand and inventory dynamics look like 1996-1997 and 2010-2014 periods where crude oil rose 53-99%

- The 60% rise in crude from the summer, 2017 lows should see corporate returns rise by 400-600 bps

- The normalization of corporate returns in the energy sector is the key to reversing the all-time low valuations of the energy sector versus global equities

Source: UBP, Bloomberg Finance, IAEA, U.S. Dept. of Energy

____________

Why we Chart the Course? Charts speak a thousand words. They visually and concisely show economic, financial, and market trends. Charts help us build assumptions and conduct analyses for strategic decisions like exiting businesses, deploying capital, building investment portfolios, etc. In Charting The Course, we bring to your attention some of the charts we gather and analyze in our daily research and analyses of economy, business environment, investment and capital markets. We hope you find it of value.

_____________

With a current team of 48 finance specialists in three offices across eleven time zones, Defoe Redmount serves as a 1st call financial partner for entrepreneurs, helping them grow businesses and wealth. We do that by investing capital in our clients and their businesses, investing assets for clients, and offering strategic advice and connections. Since 1824 in Europe and since 1994 in the United States.