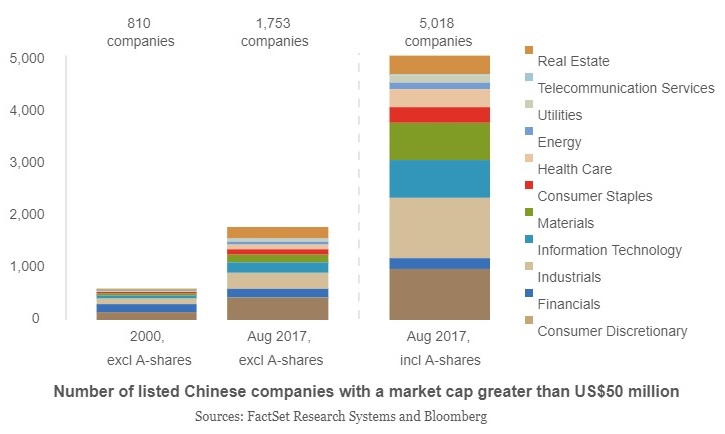

The liquidity, depth and breadth of China’s listed companies is now second only to the U.S.

- Number of listed Chinese companies with a market cap greater than US$50 million exceeds 5,000

- Growth is driven by key sectors, including Consumer Staples Materials, Information Technology, Industrials, Financials and Consumer Discretionary

- Investment opportunities in China continue to expand and change due to: Growing domestic wealth, Technological innovation, Entrepreneurship, Financial reform

- Chinese economy has rebalanced towards the private sector

-

It has diversified with a shift towards services and consumption, mainly Tech, Travel, Health care, and E-Commerce

- It has undergone a remarkable transformation, with Consumer and Services share of GDP overtaking Manufacturing and Construction

____________

Why we Chart the Course? Charts speak a thousand words. They visually and concisely show economic, financial, and market trends. Charts help us build assumptions and conduct analyses for strategic decisions like exiting businesses, deploying capital, building investment portfolios, etc. In Charting The Course, we bring to your attention some of the charts we gather and analyze in our daily research and analyses of economy, business environment, investment and capital markets. We hope you find it of value.

_____________