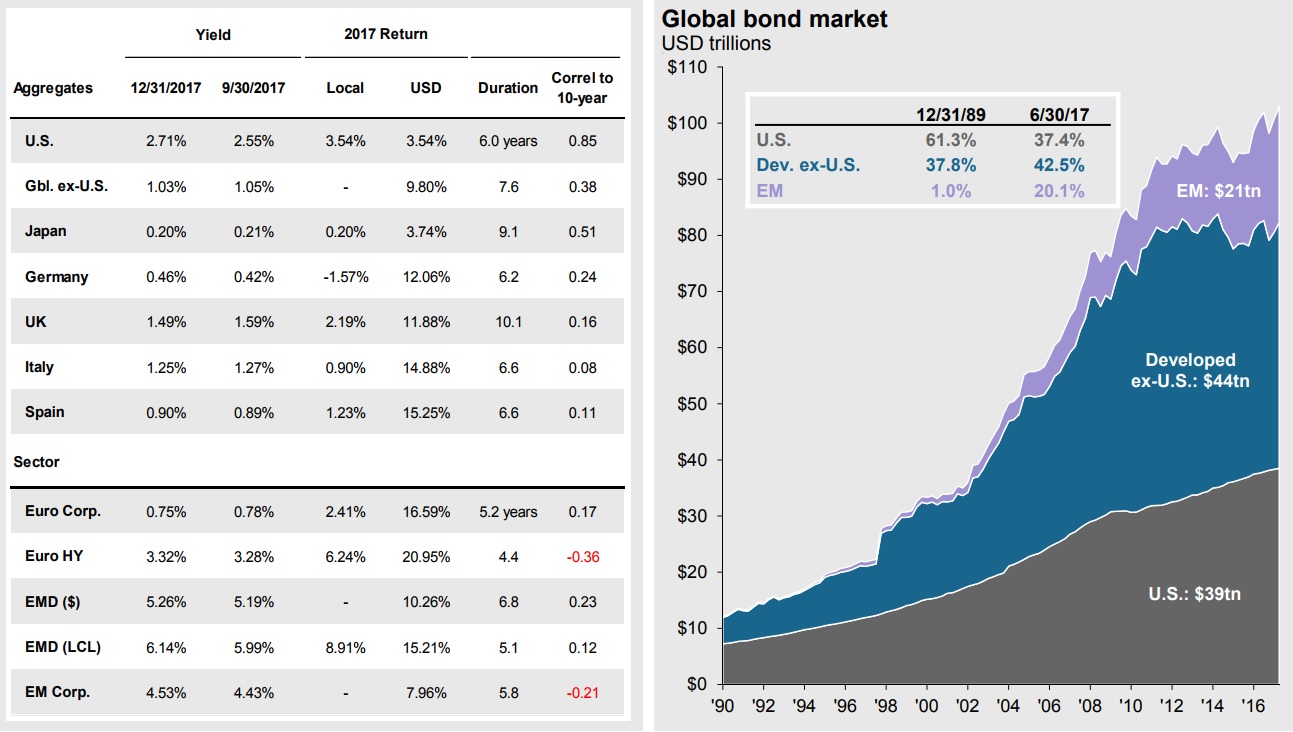

With most central banks tightening money supply and increasing rates what to expect of global fixed income markets

- Across developed and emerging markets, inflation, central bank policy and protectionism pose the biggest potential risks to fixed income

- Valuations are tight across most developed market fixed income asset classes, but corporate fundamentals appear healthy and default rates remain low

- Given the tighter spreads in developed markets, emerging markets, particularly local debt, continue to look relatively attractive

- In 2018, active strategies may provide an efficient way of protecting against downside risk

Source: Various public sources, JP Morgan Asset Management, etc.

____________

Why we Chart the Course? Charts speak a thousand words. They visually and concisely show economic, financial, and market trends. Charts help us build assumptions and conduct analyses for strategic decisions like exiting businesses, deploying capital, building investment portfolios, etc. In Charting The Course, we bring to your attention some of the charts we gather and analyze in our daily research and analyses of economy, business environment, investment and capital markets. We hope you find it of value.

_____________