What goes up must come down. For private equity firms in the US, that means an eight-year gold rush for raising new cash may finally be coming to an end.

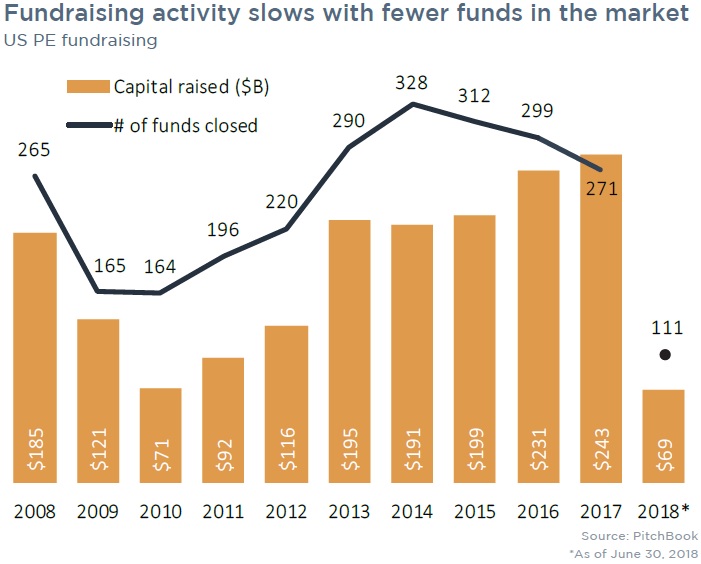

Between 2010 and 2017, the amount of capital US PE firms raised annually for new funds increased more than threefold, rising from just shy of $71 billion to last year’s figure of $243 billion—the highest total in a decade. But those investors closed only $69 billion worth of new funds during the first half of 2018, according to PitchBook’s latest US PE Breakdown, a far cry from 2017 and on pace for a six-year low.

It’s a similar story in terms of the number of new funds raised. Firms closed 111 vehicles during 1H, again on track for the lowest total in six years. But while the decline in the amount of cash raised is just beginning, the drop in the number of funds has been long underway, peaking in 2014 and falling each of the past three years.

The past half-decade, though, brought historic largesse. This year is also on pace to exceed annual fundraising totals for every year from 2009 to 2012. And you can only raise so much money: Across the industry, firms are sitting on pools of hundreds of billions of dollars in dry powder. It’s likely that the broad PE fundraising decline in the US during the first six months of 2018 is more of a market correction than a cause for panic.

Vanishing mega-funds

With fund dollar amounts rising and the number of funds falling, common sense dictates that the average size of PE vehicles in the US has been going up. In 2014, the average size of a PE fund in the US was $602 million, per PitchBook data, while by last year it had ballooned to $914 million.

That trend, too, is reversing during 2018. The average fund size in the US has fallen by nearly 50% YoY, dropping to less than $631 million so far this year.

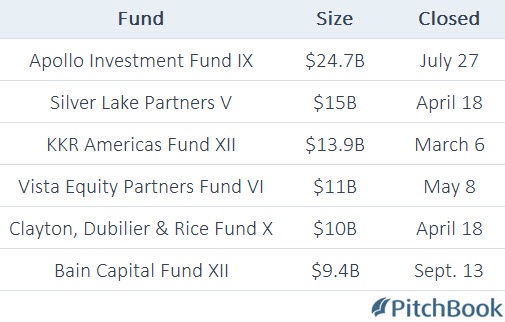

Last year was marked by a surge in mega-funds, with five different US firms raising $10 billion vehicles and 10 firms topping the $5 billion mark. Leading the way was Apollo Global Management, which gathered $24.7 billion for the largest buyout fund ever raised, while KKR and Bain Capital were among the other heavyweights to close headline-grabbing efforts during 2017:

Mega-funds this year have been few and far between. American Securities is the only US firm to raise $5 billion in the past six months, wrapping up its eighth flagship fund in February with $7 billion in commitments. While nearly 50% of all capital raised by private equity firms last year was for funds of at least $5 billion, that figure sits at just over 10% so far this year.

First-timers flourish, buyout funds pull back

One area that’s not experiencing a decline is first-time fundraising. Thirteen different US firms closed debut efforts during 1H with a combined $3.5 billion in their coffers, on track to just about equal last year’s total in terms of fund quantity and to top it in terms of dollar value. If that pace is maintained, the $7 billion raised for first-time funds would be the second-highest annual total of the past seven years.

One reason, perhaps, is the inevitable lag time in how firms respond to market conditions. Surely several of those first-time fundraisers began to raise cash in an effort to capitalize on the friendly fundraising environment that led to last year’s boom, but their vehicles didn’t close until the new year had begun.

Another trend worth highlighting during 1H 2018 is that, after spiking in popularity during 2017, buyout funds have become less frequent compared to other PE fund types.

About 77% of all US PE fundraising dollars went to a group of buyout funds that made up 65% of all vehicles last year, per PitchBook data; both of those figures were the highest since at least 2007. This year, meanwhile, they’ve fallen to 66% and 59%, respectively, essentially in line with 2016 levels.

At least a portion of that market share has moved into co-investment vehicles, driven by an increased interest in that space from some of the industry’s largest LPs. They made up 14% of all private equity funds in the US during 1H, on pace for the highest annual total in more than a dozen years.

Add it all up, and it’s clear a shift is well underway. But will it stick? If the history of private equity fundraising tells us anything, it’s that everything moves in cycles. What goes down will eventually come back up.

Source: PitchBook