As the name suggests, a “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. There may be as few as one investor for any issue.

The three most important features that would classify a securities issue as a private placement are:

- The securities are not publicly offered

- The securities are not required to be registered with the SEC

- The investors are limited in number and must be “accredited”*

Companies, both public and private, issue in the private placement market for a variety of reasons, including a desire to access long-term, fixed-rate capital, diversify financing sources, add additional financing capacity beyond existing investors (banks, private equity, etc.) or, in the case of privately held businesses, to maintain confidentiality.

Since private placements are offered only to a limited pool of accredited investors, they are exempt from registering with the Securities and Exchange Commission (SEC). This affords the issuer the opportunity to avoid certain costs associated with a public offering as well as allows for more flexibility regarding structure and terms.

"One of the key advantages of a private placement is its flexibility."

The most common type of private placement is long-term, fixed-rate senior debt, but there is an endless array of structuring alternatives. One of the key advantages of a private placement is its flexibility. Private placement debt securities are similar to bonds or bank loans and can either be secured, meaning they are backed by collateral, or unsecured, where collateral is not required. In addition to senior debt, other types of private placement debt issuances include:

- Subordinated Debt

- Term Loans

- Revolving Loans

- Asset Backed Loans

- Leases

- Shelf Issues

Traditionally, middle-market companies have issued debt in the private placement market through two primary channels:

- Directly with a private placement investor, such as a large insurance company or other institutional investor

- Through an agent (most often an investment bank) on a best efforts basis who solicits bids from several potential investors - this is typically for larger transactions: $100MM+

A private placement issuance is a way for institutional investors to lend to companies in a similar fashion as banks, with a “buy-and-hold” approach, and with no required trading or public disclosures. Historically, insurance companies refer to investments as purchasing “notes,” while banks make “loans.”

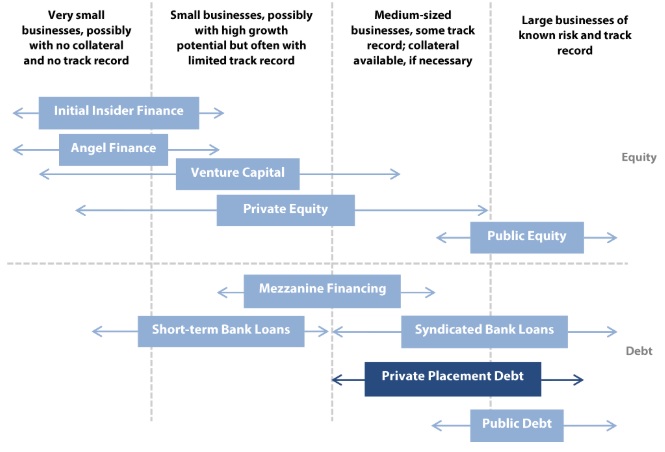

Types of Capital Available to Businesses

When businesses are started, they are often funded by the owners or a family loan. However, as they grow, many companies are unable to finance all needs solely from internal cash flows. When capital needs exceed cash-on-hand, businesses can utilize the following types of capital:

Private Placement Advantages

Private placements present the following advantages:

- Long Term

Private placements provide longer maturities than typical bank financing, at a fixed-interest rate. This is ideal for when a business is presented with a growth opportunity where they wouldn’t see the return on their investment right away; a business would have more time to pay back the private placement while having certainty of financing cost over the life of that investment.

Also, private placements are typically "buy-and-hold," so the company would benefit from having a long-term relationship with the same investor throughout the life of the financing.

- Speed in Execution

The growth and maturity of the private placement market has led to improved standardization of documentation, visibility of pricing and terms, increased capacity for financings as well as overall increase of size and depth of the market ($10MM - $1B+). Thus, the private placement market fosters an environment that allows for quick execution of an investment, generally within 6-8 weeks (for the first transaction. Follow-on financings can be executed within a shorter time frame).

Additionally, it is typically faster to issue a private placement versus a corporate bond in the public market because the issuer is not required to expend time and resources creating a prospectus and registering with the SEC.

"Private Placements can complement existing bank debt versus compete with it."

- Complement to Existing Financing

Private placements also help diversify a company’s sources of capital and capital structure. Since the terms can be customized, private placements can complement existing bank debt versus compete with it, and can allow a company to better manage its debt obligations. Diversification of funding sources is particularly important during market cycles when bank liquidity may be tight.

Private placements enable privately-held, middle-market companies and public companies to access capital just as they would with an underwritten public debt offering, but without certain requirements, such as ratings, registrations, or minimum size. And for public companies, private placements can offer superior execution relative to the public bond market for small issuance sizes as well as greater structural flexibility.

- Privacy and Control

Private placement transactions are negotiated confidentially. Also, public disclosure requirements are limited, compared to those found in the public market. Companies would not be beholden to public shareholders.

Uses

Long-term capital is congruent with a company’s long-term investments. Thus, capital raised from issuing a private placement is most commonly used to support long-term initiatives versus short-term needs, such as working capital. Companies, both public and private, use the capital raised from private placements in the following ways:

- Debt refinancing

- Debt diversification

- Expansion/Growth capital

- Acquisitions

- Stock buyback/Recapitalization

- Taking a public company privat

- Employee Stock Ownership Plan (ESOP)

Pricing and Payment Structure

Private placement debt is predominantly a fixed-income note that pays a set coupon, on a negotiated schedule. Private placements are priced similarly to public securities, where pricing is determined by the U.S. Treasury rate, with the addition of a credit risk premium.

Repayment of the principal can be accomplished in several ways, depending on the credit quality and needs of the issuer, such as sinking fund payments (amortization) or “bullets” as well as tailored/bespoke amortization. Interest is typically paid quarterly or semi-annually.

A private placement allows for tailored terms and structures to meet the specific financing needs of the issuer.

Selecting a Private Placement Investor

There are important considerations for a company when determining whether to issue a private placement. When choosing a private placement investor or lender, some key characteristics to look for are:

- They are relationship-oriented rather than transaction-orientated. It’s important that they show interest in the businesses they finance as well as work to understand the needs of the business and how it functions.

- Because private placement debt is typically long-term, it is vital for the private placement investor to have the capacity to grow as a financial partner and have the knowledge and experience to help a company navigate during challenging times.

- They are fast-acting, responsive and have access to key decision-makers within their organization.

- The private placement investor demonstrates a constant appetite for private placement debt throughout market cycles and the calendar year.

- They follow through on their commitments.

Ultimately, it is most important to find a private placement investor who can offer financing best fitted for the goals of your business. If you’re interested in issuing a private placement, Defoe Redmount is here to help.

*An investor is considered “accredited” if they meet minimum financial net worth qualifications as well as other requirements set by the federal government; They are considered to be more experienced and are the only investors allowed to purchase private placements. Being accredited should imply that the investor has the knowledge required to make prudent investment decisions but also that they can afford to take a loss should something go wrong.